Latin America’s expanding crypto footprint

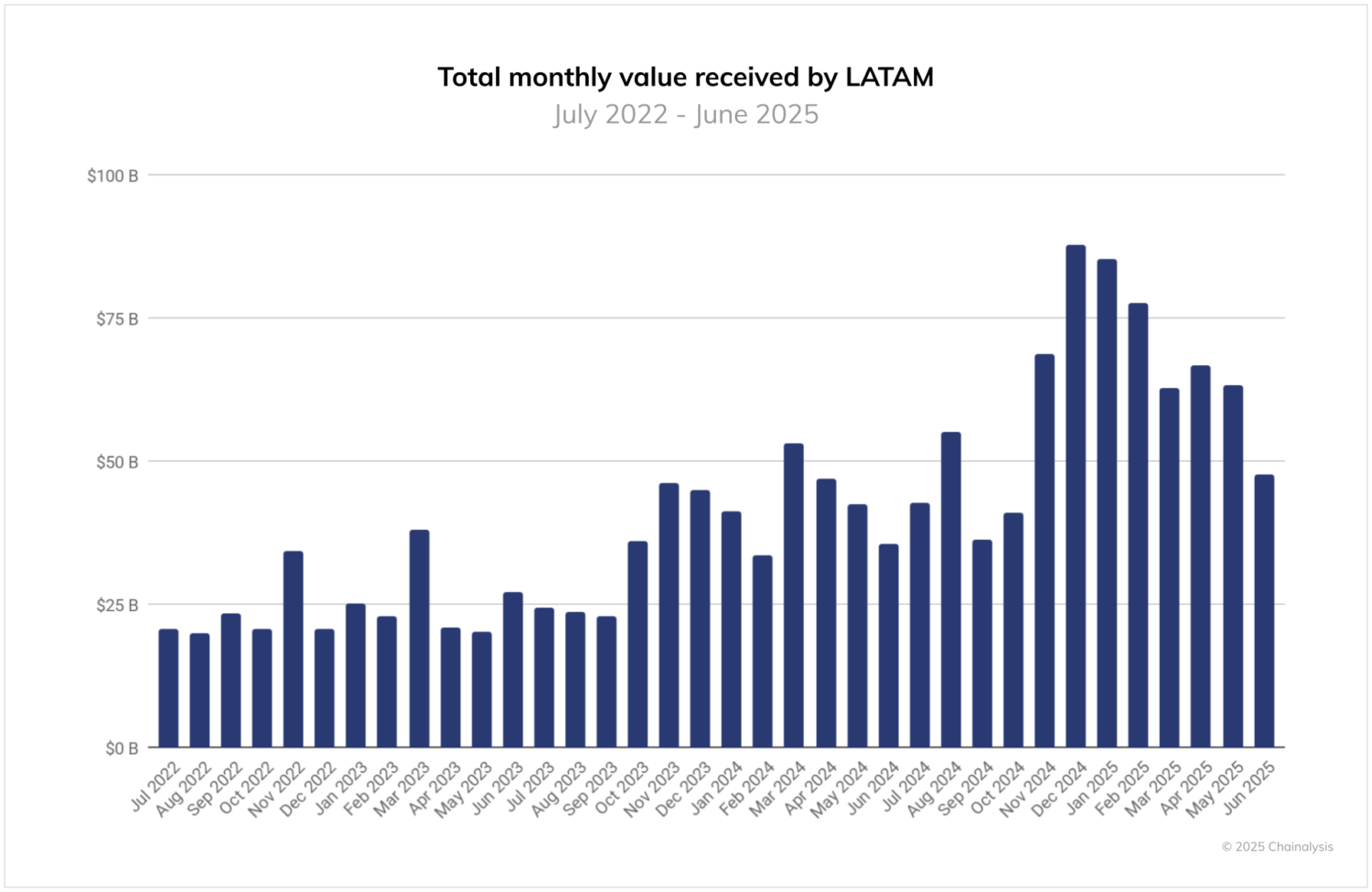

Between July 2022 and June 2025, Latin America recorded nearly $1.5 trillion in cryptocurrency transaction volume, establishing the region as one of the most dynamic in the world. The trajectory has been volatile but unmistakably upward: from $20.8 billion in crypto transaction volume in July 2022, activity surged to a record $87.7 billion in December 2024, with multiple months in late 2024 and early 2025 sustaining levels above $60 billion.

Key growth phases included:

- November 2022 and March 2023, when monthly totals jumped above $34 billion and $37 billion, respectively.

- Late 2023, which delivered a string of record highs, including $46.3 billion in November and $45.1 billion in December.

- 2024 year-end, when volumes more than doubled over the previous year’s peak, culminating in the $87.7 billion December high.

While volumes cooled slightly in the first half of 2025, with figures moderating to $47.9 billion by June, the region remains on a significantly higher baseline than in 2022 or 2023, highlighting enduring momentum behind crypto adoption, despite short-term volatility.

This trajectory reflects not only industry-wide growth in crypto adoption globally, but also Latin America’s unique economic context. As we have noted in previous years, the trifecta of persistent inflation, currency volatility, and restrictive capital controls across several countries in the region continues to drive demand for stablecoins as a safe store of value and as a hedge against local macroeconomic risk. At the same time, the region’s position as a top remittance corridor has accelerated the demand for crypto to facilitate faster and cheaper cross-border transfers.

The wider LATAM crypto ecosystem

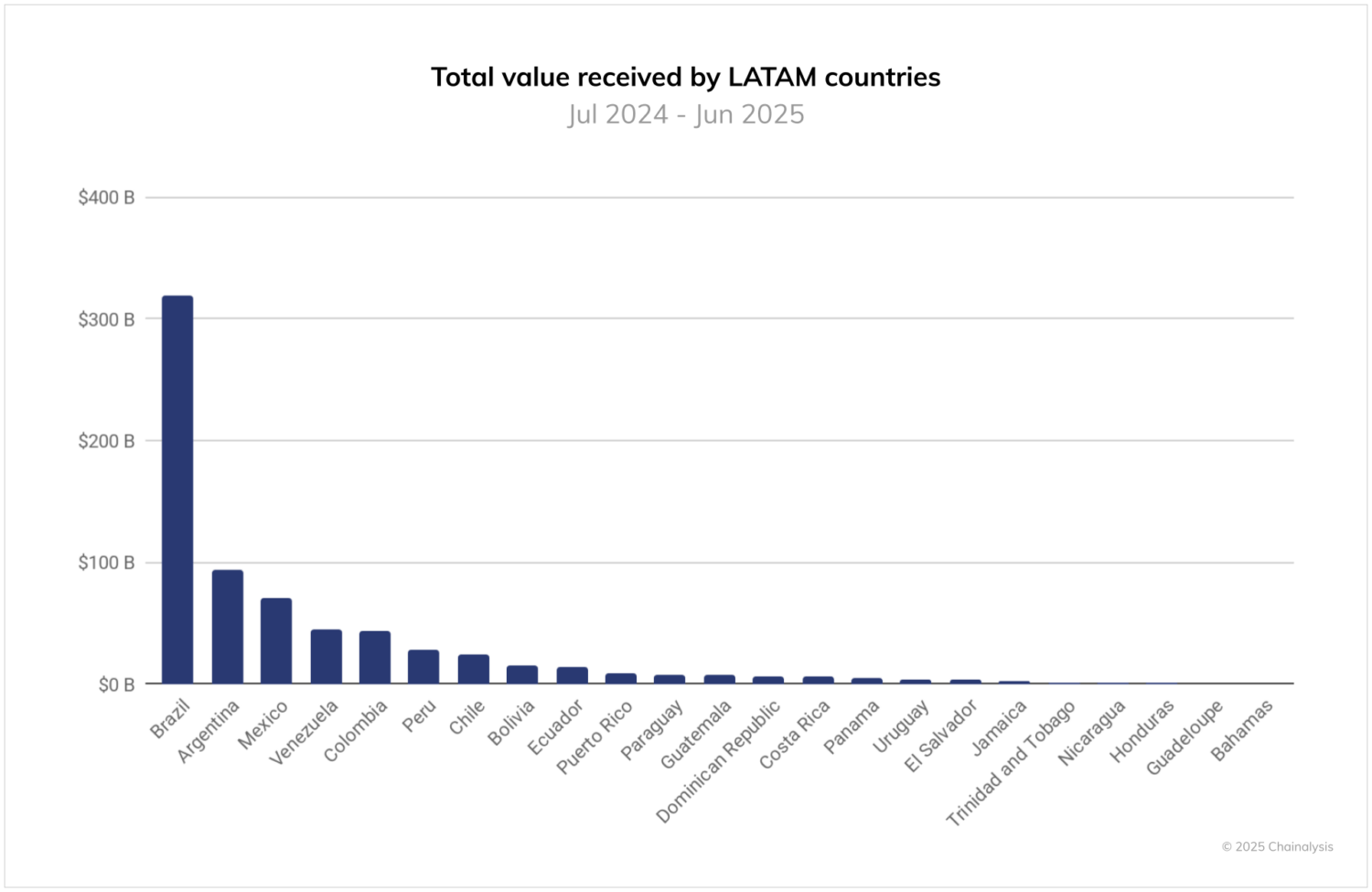

Brazil dominates the LATAM region with $318.8 billion in crypto value received, accounting for nearly one-third of all LATAM crypto activity. This dramatic increase represents one of the most significant growth stories in the region, establishing Brazil as LATAM’s clear crypto leader.

Argentina ranks second regionally with $93.9 billion in transaction volume, consistent with trends observed in our previous Adoption Index. Mexico ($71.2 billion), Venezuela ($44.6 billion), and Colombia ($44.2 billion) round out the top five. Smaller markets such as Peru ($28.0 billion), Chile ($23.8 billion), and Bolivia ($14.8 billion) also play meaningful roles, while El Salvador, despite its well-known fondness for bitcoin, contributed more modest volumes ($3.5 billion).

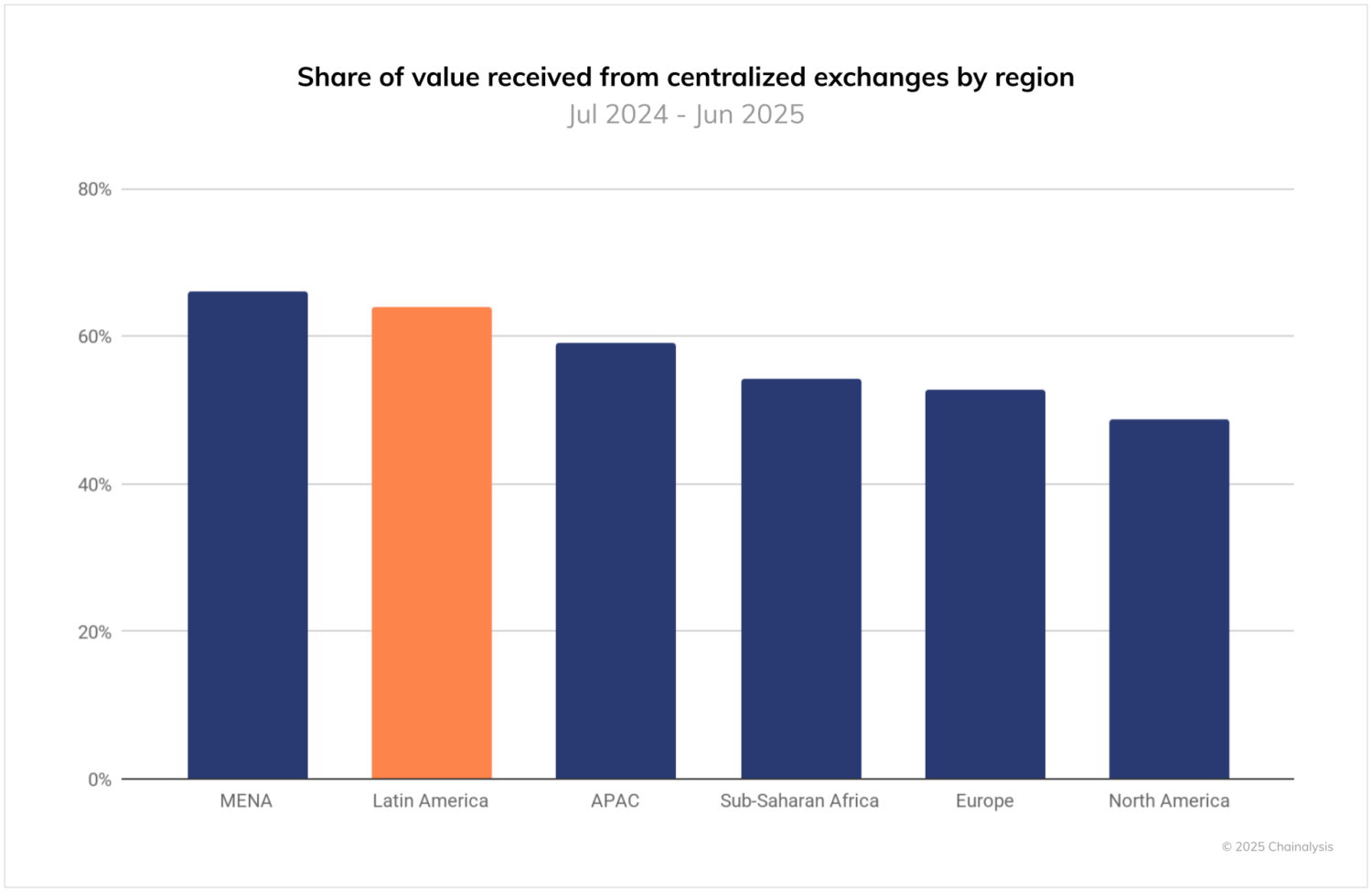

Centralized exchanges remain the dominant entry point for crypto across most regions, but Latin America stands out with 64% of activity taking place on CEXs, second only to the MENA region (66%) and significantly higher than both North America (49%) and Europe (53%). This reliance on centralized platforms reflects both accessibility and trust: for many users in the region, exchanges offer the most straightforward way to acquire cryptocurrency, trade crypto, and move money across borders. Prominent local platforms such as Mercado Bitcoin (Brazil), Ripio (Argentina), Bitso (Mexico and Colombia), and SatoshiTango (Argentina) have become household names, building strong user bases by offering fiat on-ramps, remittance services, and integrations with local payment systems.

Brazil leads the LATAM region

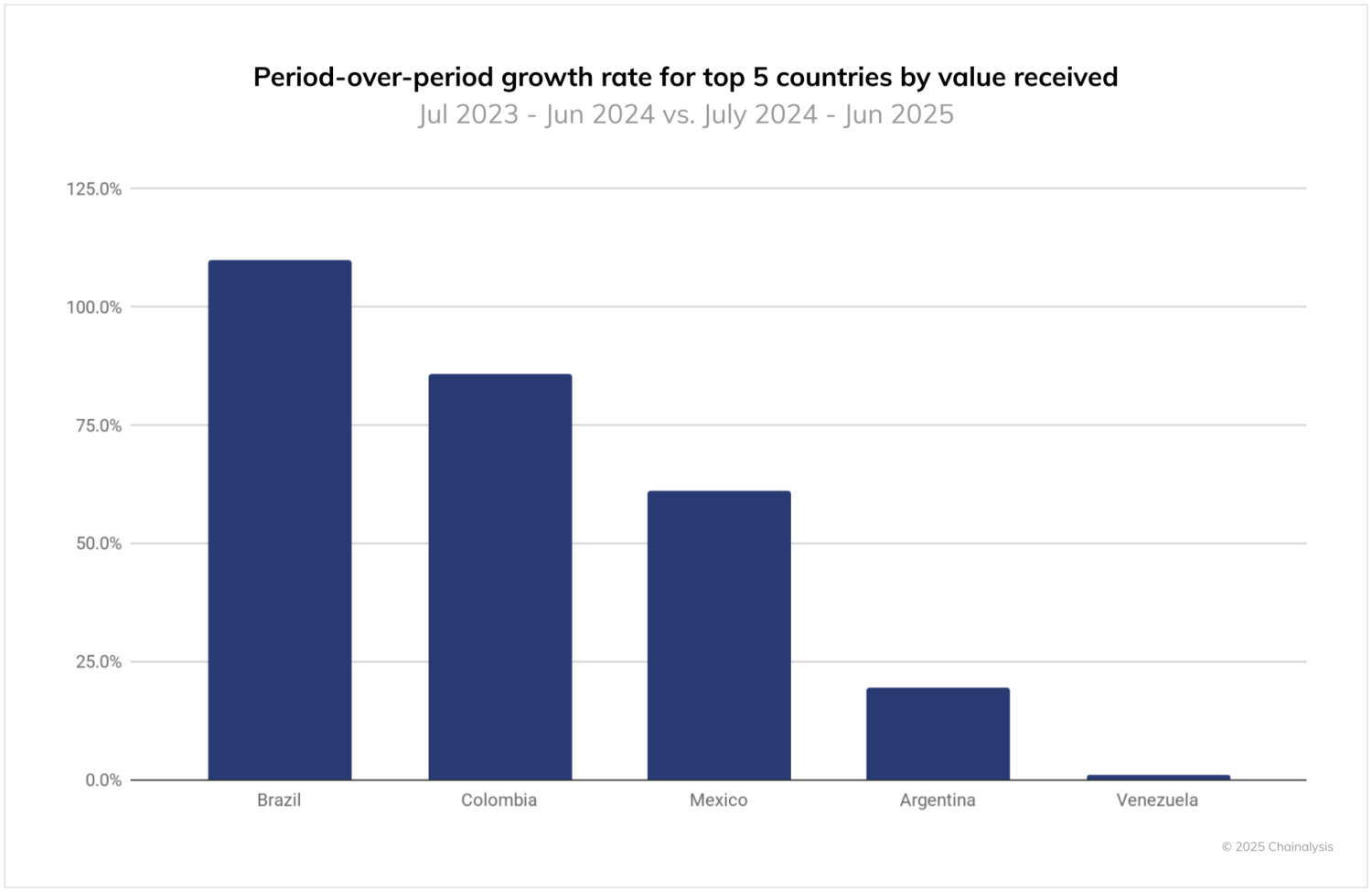

Beyond leading in total transaction volume, Brazil’s period-over-period growth rate of 109.9% underscores its position as the region’s most dynamic crypto market. This exceptional growth trajectory stands in sharp contrast to other major LATAM markets, as shown in the chart below.

While crypto policy and regulation in LATAM tend to lag behind adoption, Brazil is one of several countries that have already implemented meaningful crypto regulations, including its 2022/2023 Brazilian Virtual Assets Law (BVAL), which set requirements for crypto firms (including KYC and transaction reporting) and established the Banco de Brasil (BCB) as the relevant AML/CFT authority. In Brazil, there is still enthusiasm to progress further, suggesting that momentum will continue at pace with the release of a series of consultations (Nos. 109, 110, and 111/2024), from which rules are expected by the end of 2025.

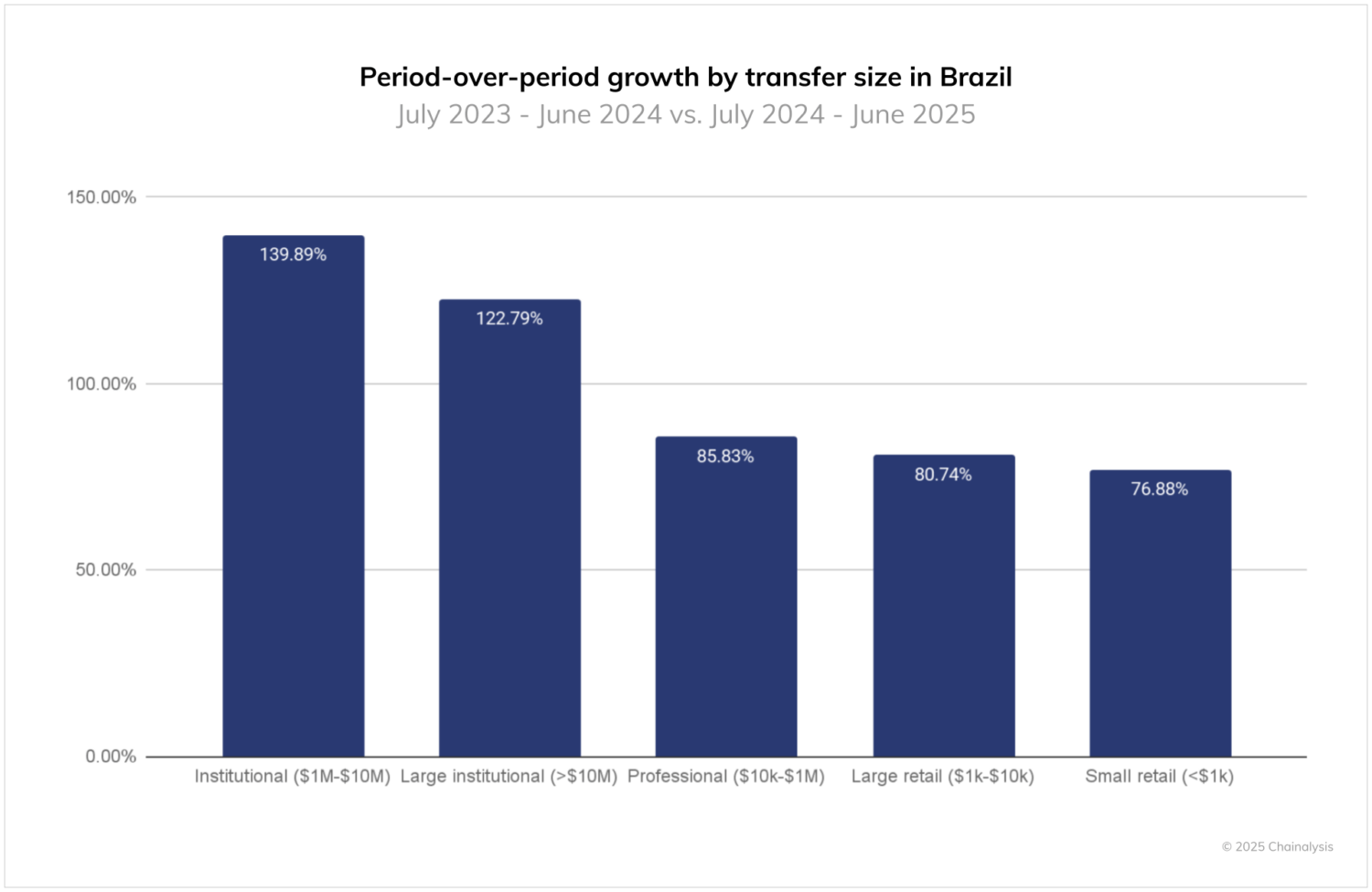

The growth in the Brazilian crypto economy has been driven largely by institutional and large institutional transfers, both of which grew in excess of 100% period-over-period. But the data also suggest that Brazil’s growth is broad-based, with meaningfully large increases for all transfer sizes.

Stablecoin usage surged significantly, with officials reporting that over 90% of Brazilian crypto flows are now stablecoin-related, underscoring their crucial role in payments and cross-border transfers. This flourishing stablecoin market, combined with increasing transaction volumes, cements Brazil’s position as a regional growth hub.

Institutional engagement with crypto, which we’ve tracked in previous years, remains a vital driver of this growth with many of the BCB’s past regulatory decisions serving to help create the dynamic ecosystem into which larger institutions can enter. Encouraged by this, traditional banks like Itau and neobanks such as Mercado Pago and Nubank have entered the space. As we move toward a more regulated environment by the end of 2025, we expect Brazil to maintain its central position, building on strong institutional interest. This trajectory depends on striking the right regulatory balance to ensure retail activity remains safe, well-supported, and attractive to participants.

LATAM’s stablecoin and exchange activity

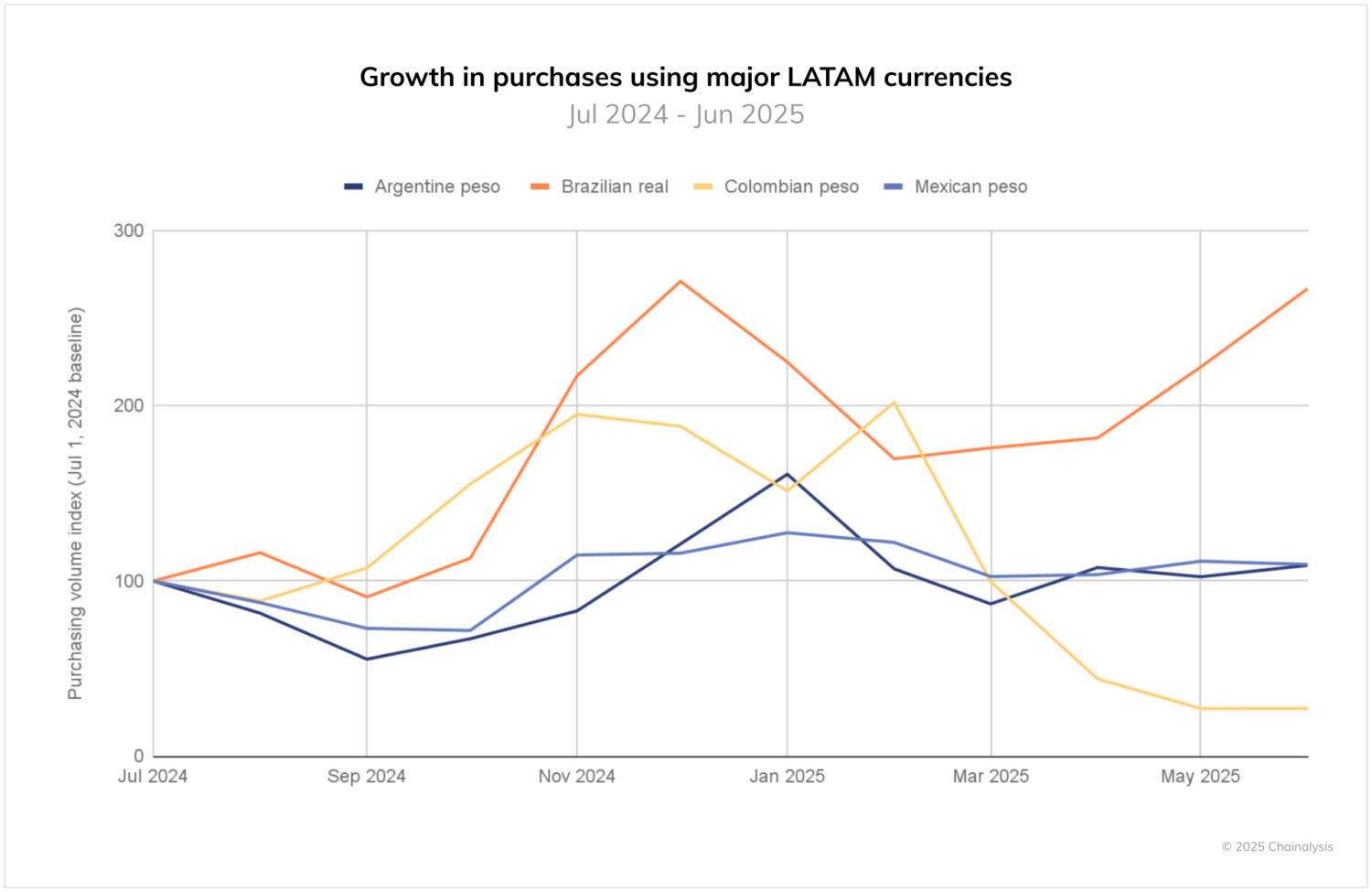

In fiat-to-crypto transactions, Brazil’s market leadership is even more pronounced, with the strongest period-over-period growth in cryptocurrency purchases using local currency. This contrasts with Argentina and Mexico, where activity has been relatively stable, and Colombia, where crypto purchases have more notably ebbed and flowed.

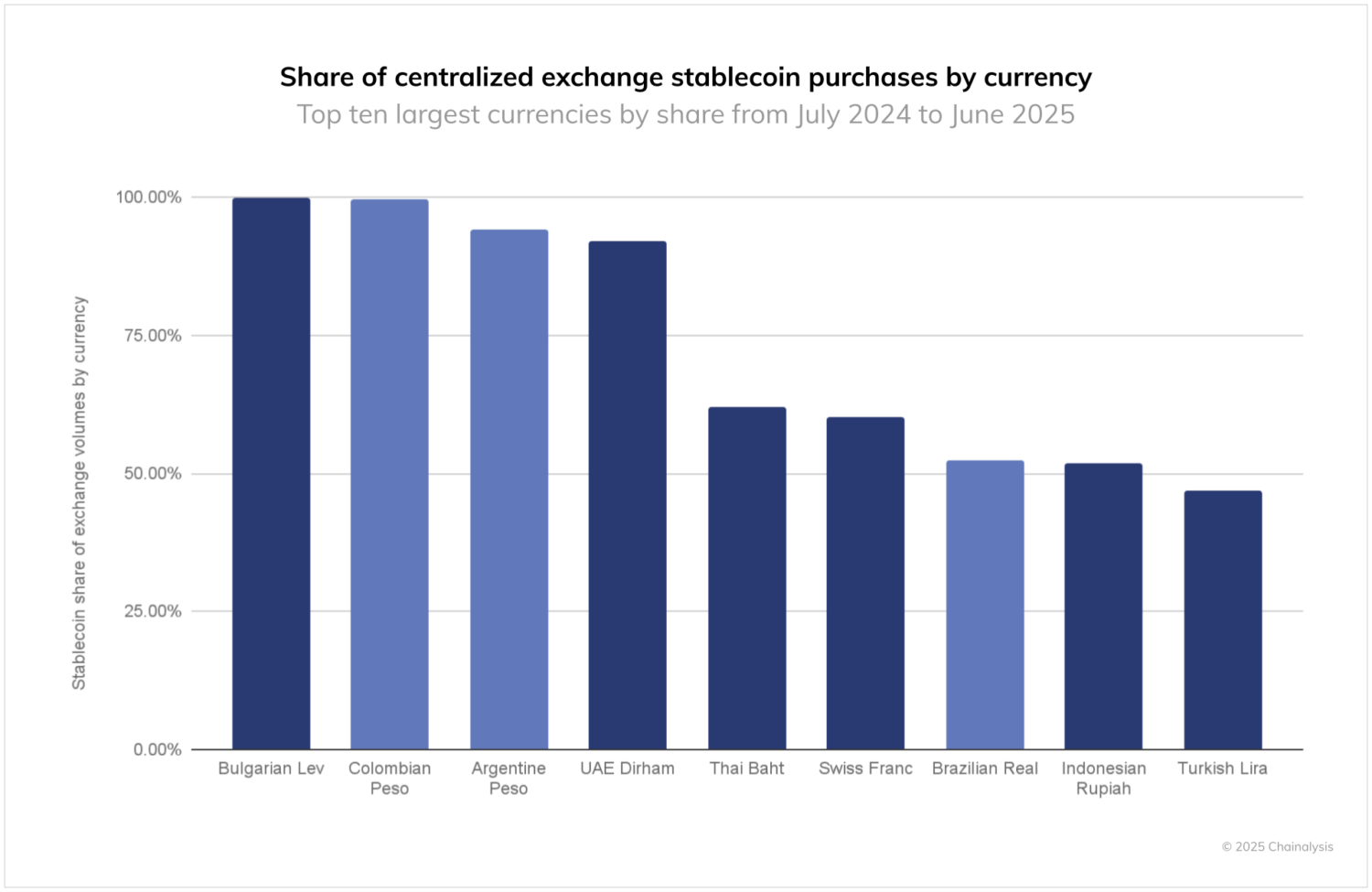

Much of this exchange activity involves the purchasing of stablecoins. In the case of the Colombian Peso, the Argentine Peso, and the Brazilian Real, stablecoin purchases make up over half of all exchange purchases between July of 2024 and the end of June 2025 (note that this is based on order book data included in CryptoCompare and is therefore not a comprehensive view of all CEX activity). The dominance of stablecoins in Latin America reflects persistent inflation, currency volatility, and capital controls, which drive households and businesses to seek U.S. dollar-linked stability for savings, remittances, and commerce. In effect, stablecoins serve as a parallel financial system, offering both a hedge and a practical payments tool where local currencies often fail to provide stability.

Looking ahead, Latin America’s crypto ecosystem appears poised for continued growth, driven by the interplay of institutional adoption in markets like Brazil and persistent retail demand for stablecoins across the region. While each country faces unique challenges and opportunities, the region’s overall trajectory suggests that crypto, and particularly stablecoins, has evolved beyond early adoption to become an integral part of Latin America’s financial landscape. As stablecoins continue to serve as a crucial hedge against local currency volatility and an efficient means of cross-border transfers, the key to sustaining this momentum will lie in striking the right balance between innovation and regulation, particularly as more countries follow Brazil’s lead in developing comprehensive crypto frameworks.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.

No hay comentarios:

Publicar un comentario